A quick note on inflation and price controls

I am a loud and proud member of "team transitory"—I’ve argued that the recent spike in the Consumer Price Index (CPI) is a temporary shock to the system, the result of household incomes and consumption recovering from the pandemic faster than supply chains can keep up with demand. However, inflation is still a problem in the short run. These aren't mutually exclusive statements. Even if we understand that there are supply-side causes to inflation due to low capacity, it is also true that capacity takes a while to install.

Moreover, I have also argued that our system has a deflationary bias that reduces wage growth. That is undoubtedly true, but inflationary pressures, especially gasoline, are politically harmful and reduce the maneuvering room for progressive politicians who want to build a wage-led economy in which growth benefits workers more than the owners of capital. In the long run, I believe that the best way to inflation-proof our economy is to manage capacity to make sure there are enough reserves to use before pressure builds up. Short-term measures need to be coupled with long-term efforts to hit bottlenecks before they appear. My friend and colleague Skanda Amarnath – probably one of the smartest economic commentators out there – summed it up in this tweet.

Most countries have soft price controls for things that are volatile in spot markets and necessary (like electricity), we just don’t like to talk about it.

— Skanda Amarnath ( Neoliberal Sellout ) (@IrvingSwisher) December 30, 2021

But also true that calling for price controls without a politically credible plan for augmenting capacity is kinda doomed

Skanda refers to price controls, one of the options for reducing short-term inflation. This discourse about price controls was spurred by an article in The Guardian by Isabella Weber advocating for them. Many economists don't like price controls, and there are good reasons for why. They do tend to defer inflation and merely cover up the symptoms rather than preventing it altogether. They usually require some level of rationing, which is a very fraught political issue. However, the answer from the mainstream economics community on how to deal with inflation isn't that much better. The call to hike interest rates from some of the profession's loudest voices is a call to slow down the economic expansion and curtail labor bargaining power by raising the cost of credit through the central bank. Rather than spending larger paychecks on consumer goods that are in short supply and thereby driving up prices, workers and businesses see more of their incomes eaten up by debt servicing—if they aren’t laid off or bankrupted altogether. That's an oversimplification but let us not get bogged down in it for now.

We are left with a huge set of tool kits to deal with prices. I like to see it as a layer cake:

- The first layer is an industrial policy designed to push forward innovative production and make sure there are sustainable supply chains for that production.

- The second layer is a savings and incomes policy that guarantees demand by putting a floor under consumption but also encourages households to invest in public instruments and thus put some caps on consumption.

- The third layer should be credit and price controls meant to tamper down on extremely volatile components of CPI.

- The fourth layer – the red button – should then be aggressive interest rate hikes.

The purpose of this post is to discuss some ideas for how to deal with short-term inflationary bouts to pave the way for a wage-led economy. In addition to commenting on the hikes v. price controls debate that Weber's article has inspired, I want to propose another way – deferring consumption via public savings. This is the proposal made by Keynes during the Second World War and is also present in Adolph Lowe's theory about how to cross a traverse toward a full-employment economy. These are not exclusive options, and I think they should all be stacked on top of one another to build a better system for governing the economy.

Most economists would argue that inflation is a monetary phenomenon, so best dealt with via higher interest rates. In the textbooks, the process through which this works to reduce inflation is through expectations. By controlling the short-end interest rate, the central bank will make the longer end of the yield curve move up, raising the borrowing cost. This is important because inflation is thought to be driven by expectations of future price increases, which leads to a cumulative process wherein workers will bargain for higher wages to meet them. Wage pressures then lead to higher prices creating a "wage-price spiral." The central bank can cut into this spiral by setting expectations of higher borrowing costs.

There are some problems with this story. First, as the now-infamous paper by Jeremy Rudd argues, inflation expectations are a just-so story that makes priors about long-run market-clearing work. They have no solid theoretical or empirical grounds. If anything, Rudd claims that expectations are a matter of institutional arrangements like the cost of living adjustments and union bargaining strength. If we discard expectations, then the mechanism behind rate hikes becomes far more transparent. Rate hikes slow growth by making credit scarcer and signaling to governments to cut spending. Cuts to spending and investment slow the growth of the economy and thereby change the bargaining dynamic between labor and capital, especially with unions as weak as they are (With stronger unions, you can manage inflation via handshake agreements between labor and capital. I will discuss this later on and in future posts). This fall in relative bargaining power then reduces worker consumption, thereby reducing inflationary pressures. Paradoxically, this same effect can also make it harder for private businesses to invest in the new capital stock necessary to break through bottlenecks and make the economy more fragile in the long run.

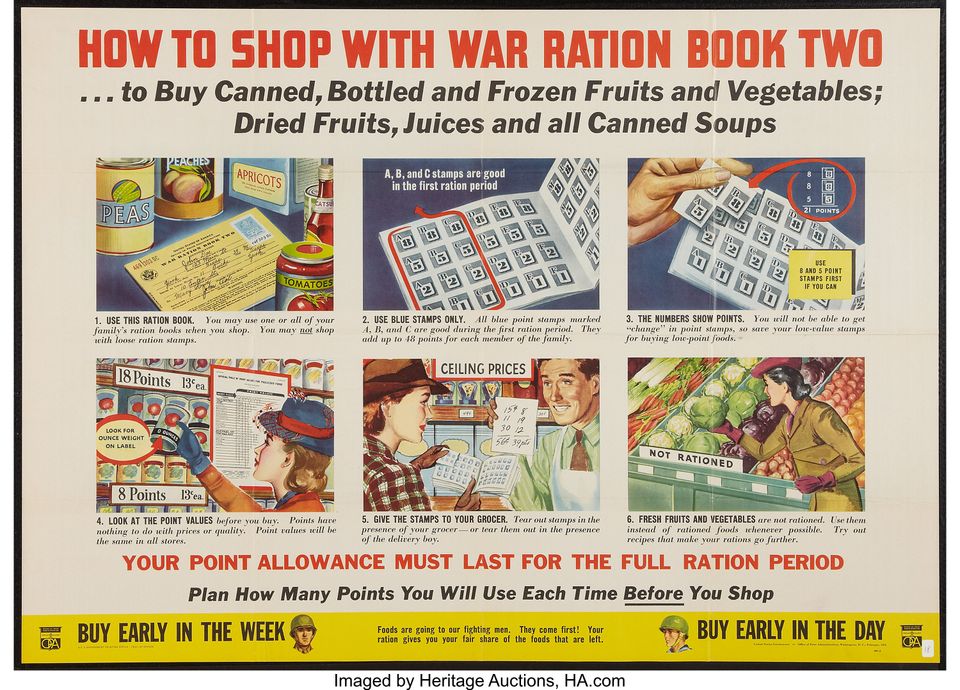

An alternative some would argue for is price controls. Weber makes a case for the effectiveness of price controls in the cooling of inflation during the Second World War and its aftermath. I am not opposed to price controls, but we have to be honest about how they work. First, price controls will involve some rationing. That is fine in an emergency, and we certainly are in one. In fact, we ration things all the time, most notably healthcare.

Thus, as Skanda's tweet points out, we have price controls, especially in volatile markets. Effective price controls do not stop the growth of prices; they tamp down on price volatility. That is partly because price controls, like all things economic, are also political. To get them to work, you would have to have a strong coalition between capital and labor where one side agrees to limit access to goods or limit wages (itself a price control) and the other to restrict profits by not raising prices.

Price controls on commodities that aren't labor require a similar set of strong coalitions where the consumers and producers can have a quid-pro-quo. Think about electricity rates. Utility rate regulations emerged as powerful industries needed electricity to work and did not want to deal with the kinds of price spikes Texans are now dealing with in a very market rate system. On the other hand, utilities needed revenues both to make some profit and to pay for investments. A bargain was struck for a pricing formula to apply: a price control.

I am frankly not sure we can do this overnight in the United States, nor do we have the government capacity to force this kind of agreement on any market we choose. I do think we should build these kinds of capacities, and not just to be able to control prices. Success breeds success, and building the institutions to create these kinds of agreements are generally good for the economy. I have some ideas for "low hanging fruit," but even these are a reach without a significant political change.

A classic compromise is to have the state directly invest in strategic sectors that are volatile and critical to manufacturing inputs. One idea I have been toying with is having a government-owned corporation take equity stakes in small shale producers to both increase supply and cap the price of their output. Shale is a very volatile business. It depends on private creditors' willingness to lend into what is inherently a swing market. After being burned twice, private creditors aren't lending. This is driving up the price of energy. Access to public financing helps change this dynamic and lets us regulate the price levels of a critical input. The government essentially buys the political goodwill for price controls from the private sector by guaranteeing access to capital.

One problem is that shale is also environmentally destructive. In the long run, we will want to move away from such energy sources. So let's kill two birds with one stone: our new investment vehicle's mandate can include actively taking shale offline by buying out other holders at a pre-determined rate. This would give the government some tools to actively transition to a low carbon economy while also ensuring a steady price for energy in that transitionary period. That stable price will give us more political and fiscal room to bring new power sources online and replace gas altogether. Another neat advantage of this is that publicly owned "dirty funds" do not have the mandate of making a profit. Privately owned dirty funds do, and disinvestment campaigns have been a boon to them. In fact, in many cases, they have expanded rather than contracted the extraction of fossil fuels by giving dirty fuel funds a fire sale price for uneconomical assets in the context of another portfolio but have a reasonable rate of return in other contexts. Of course, getting to this would require working on the other end of the spectrum and actively spending to reduce the demand for fossil fuels. Politically, it will be much easier to do this if we can limit price volatility in the meanwhile.

Another area I can easily see some new institutional arrangements working in is housing. This is because we already have an implicit price control for housing credit through the government's many programs that support long-term fixed-rate mortgages. I have argued that homeownership isn't a great vehicle for household savings, but the reality is that it becomes so because there is implicit leverage given to home buyers by the government, which doesn't exist in other assets. I think that's a mistake, and later in this post, I will offer an alternative. But for the time being, let's put that aside and see how we can control the cost of housing. The answer here is straightforward: build more of it where people want to live! And to make sure it is affordable, we should do what Paul Williams suggested in an article for Noema and have the government be a developer using publically owned market-rate units to subsidize low-income units. Second, we can also follow Matthew Klein's suggestion and target credit for housing by having Fannie and Freddie charge a high government insurance fee. This credit control makes it a bit more expensive to buy a house without raising overall interest rates.

Finally, we should be controlling the price of prescription drugs and other vital medical care. That's just common sense around the world, but alas…

I find it somewhat surprising and maybe a bit telling that monetary hawks have not tried another well-known tool to fight short-term inflation: deferring consumption through forced or highly encouraged voluntary savings. Forced and voluntary savings were discussed by Keynes in 1940's How to Pay for the War. In this pamphlet, the great economist argued that the military emergency of the war required Britons to cut their consumption and move productive power into producing war goods – you can't eat a Spitfire! Otherwise, the transfer of real resources to the military-industrial complex means that consumer goods are scarcer, and their prices increase. In turn, it could lead to an inflationary spiral.

To prevent such an inflationary spiral, Keynes suggested a forced savings scheme to have workers deposit some of their earned income into a savings instrument. These savings would be gradually released, with interest, after the war as the economy returned to normal production with plenty of goods to spend them on. The release of these funds could be timed countercyclically with a slump in the business cycle caused by a withdrawal of government orders to increase consumer demand. It could also be designed to help the average person save for retirement. Keynes suggested an automatic rollover into retirement for savers if they so choose. In general, it would create a much more egalitarian distribution of wealth. Keynes also advocated an allowance for families to offset some of the nominal effects of this forced labor scheme since children were not wage earners – think of the Child Tax Credit!

However, Keynes was critical of voluntary savings schemes because they favored the rich. Rich people can buy savings bonds, but the poor need to consume out of income. This is fair and particularly useful to think about in the context of a war where the economic shock is massive, and solidarity is high enough for a variety of actions – including effective price controls.

In our situation with COVID and climate change, the issue is a bit different. Industrial war presents a sense of immediate danger and fear of death that breeds solidarity. For whatever reason, I do not think we have that luxury in our current crises. However, if administered by the government, voluntary savings should be enough and are politically viable. The good news is that instruments for this already exist. The treasury issues "series I" and "series EE" savings bonds available for all Americans. Series EE bonds are guaranteed to double overtime, and series I are inflation-protected. The thing is that no one knows about them. And even if you do know about them, Treasury Direct, the only website where you can get them, is designed to be as hard to navigate as possible! Finally, you are capped at buying $10,000 outright and another $5,000 with your tax return.

I think that we should expand this system. We should be screaming for Americans to deposit their savings into these safe assets. In some ideal world, I would love to see rent become a tax write-off and leverage applied to these assets as much as to private houses. Suppose you are worried about basic income or emergency checks being inflationary. In that case, Uncle Sam could give you the option to trade your $2,000 check (or whatever combination or sum of money) into a $2,500 series I that expires in ten years. There are all kinds of sweeteners you can think about, like letting it convert into a SELFIES retirement bond as proposed by Robert Merton.

We can think of all kinds of schemes here that build a publicly owned savings system that can be used for public purposes. This strategy is very consistent with Lowe's traverse theory of growth since any traverse requires some savings to go up as consumption temporarily falls. Lowe, unlike Keynes, did prefer voluntary savings since they were more democratic. To my knowledge, Lowe did not write much about politics but to counter the regressive nature of voluntary savings; we should put some caps on the volume and rate of the instruments that individuals can buy.

We should also limit who can buy them to specific individuals and even institutions like pension funds. Those limits, however, should be driven by balancing equity concerns with the need for a savings policy that serves the traverse. Right now, they are primarily there to avoid disrupting the private market for savings instruments. Finally, progressiveness is a matter of outcomes. I can take the political hit of some outsized return to the middle-classes over the poor to sustain the political will for action on society's pressing problems and redress poverty through other means.